It is possible to receive quotes for term life insurance for seniors from the age of 70. You should understand that insurance companies view this as a higher risk because seniors’ health deteriorates with age.

In fact, getting life insurance at this age is risky as the mortality rate for both men (70) and women (80) is a decade.

However, term life insurance for seniors over 70 can be affordable if you are healthy, take minimal medication, and have no major health problems.

Life Insurance for Seniors Over 70

The only thing to watch out for are hybrid products that claim to offer things that just don’t make sense. For example, advertisements that you receive in the mail or late-night television advertisements.

In these cases, be sure to read the advertiser’s information as your survival benefits for your family will depend on it.

Most of the time, you will find that these commercials and television commercials are just a trick and are not worth the paper the ink is on. Beware of the 75% Money Back Plan!

If you are an adult over 80 years of age, consideration of life insurance should be a priority This type of life coverage can cover expenses such as outstanding debts and funeral expenses and help preserve your family’s financial stability.

Life insurance for people over 70 helps pay for long-term care: Here’s how

Why Do You Need It?

If you don’t have enough money to cover these costs, buying life insurance is your best option. You should purchase one of these policies as soon as possible to ensure affordable rewards.

Many people assume that they don’t need life insurance. However, this is the best way to cover funeral and funeral expenses. Funeral costs continue to rise and most people haven’t saved enough money for such expenses.

Know The Cost of The Funeral:

In most cases, a funeral costs between $7,000 and $10,000. A funeral could cost more if your family decides to spend more on the flower arrangement or ceremony.

Having a large family attending the funeral can drive the price up. Dying without leaving enough money to pay for a funeral would be a burden on your family. Having to organize and pay for a funeral in a short amount of time can be stressful.

Cover the Cost of Your Funeral:

Don’t let your family pay for your funeral. You can help them by getting life insurance for seniors over 70 that covers these costs.

Proper funeral coverage over 85 will help ensure the financial security of your surviving spouse, and your children or grandchildren will not have to contribute the money required for the funeral.

You may think that finding the best life insurance for people over 80 is not easy. Read on for more information on buying life insurance after 80.

Health status and life insurance for people over 80 years:

You can get affordable premiums if you don’t have major health problems. You should be able to find low-premium life insurance for anyone over 80 if you haven’t recently had major surgery and haven’t been diagnosed with a serious medical condition.

But you will likely need to pass some medical tests and show that you don’t smoke or drink alcohol.

Term Life Insurance Over 70

Many factors affect how much a particular senior life insurance company will charge you for a particular policy. All of these considerations help the company determine how long you can live and therefore the likelihood that you will have to pay a claim. Some of the factors that determine how much you pay for life insurance include:

Term Length: For 30 year term life insurance, the longer the term, the more total payments you will have to pay. This is simply because you are more likely to die for a longer period than a shorter period.

Amount of coverage: The more coverage you buy (that is, the higher the death benefit) for a given type of policy, the higher the life insurance rates.

Age: This is the most important personal characteristic to determine the cost of your term life insurance over 70. All things being equal, the higher you are, the more likely it is that an insurance claim will be filed and the more you will pay.

Gender: Women often have lower life insurance costs than men because they tend to live longer.

Health History: Before selling you a life insurance policy, the insurance company will generally require a medical examination.

Family Life Insurance With Bad Health

It also reviews copies of your medical records to determine your current health and medical history. If you have a serious condition, such as heart disease, or have had one in the past, your premiums are likely to be higher. Other factors taken into consideration include weight, blood pressure, and cholesterol levels.

Finally, people in poor health can expect to pay more for life insurance because they are at increased risk for life-threatening health problems. Conversely, those in excellent health will have more affordable life insurance.

Family Health History – Many health conditions run in families, and one’s family history, even if you don’t already have it, could increase your premiums.

Smoking: This is a well-known risk factor for cancer, heart disease, and other potentially fatal conditions.

If you smoke or use other tobacco products, you generally pay more for life insurance.

Hobbies and Occupation: If you skydive, dive, or do other potentially dangerous recreational activities, you will generally pay higher life insurance rates over 70, 71, 72, 73, 74, 75 age. This is also true if you are a firefighter or have another high-risk job.

Can a 75-Year-Old Get Life Insurance?

Premiums are not the only factor to consider when purchasing life insurance. For term life insurance for elderly care over 75, you also want to get a term that is long enough to meet your needs. For example to provide coverage until your children graduate from college.

Permanent life insurance, like total or universal life, has other considerations, including the rate of return on your investment and the rate you would be charged for borrowing against the life insurance for seniors over 70 policy.

Our guides on comprehensive life insurance for seniors over 70 and universal life insurance explain the advantages and disadvantages of this type of policy.

Senior Life Insurance Over 75

If the main reason you are buying a senior life insurance over 75 policy is to care for your loved ones, a good idea would be to buy based primarily on price.

However, if you want your life insurance for seniors over 70 policy to serve as an investment vehicle or as part of your retirement savings plan. Other factors should also be considered.

Before buying life insurance over 75 to 80 age, talk to a financial consultant who can help you think about all of these considerations.

Cost Comparison of Selected Life Insurance Companies at Affordable Cost for Older Women:-

| COMPANY/AGE | 70 Age | 75 Age | 80 Age |

| Protective | $373.15 | $670.18 | N/A |

| lincoln financial | $382.68 | $685.74 | $1,728.08 |

| Principal | $389.38 | $783.13 | $1,986.25 |

| Haven Life | N/A | N/A | N/A |

| Banner Life | $437.95 | $734.44 | N/A |

Cost Comparison of Selected Life Insurance For Seniors Over 70 Companies at Affordable Cost for Older Men:-

| COMPANY/AGE | 70 Age | 75 Age | 80 Age |

| Banner Life | $606.96 | $1,162.30 | N/A |

| Protective | $606.97 | $1,162.31 | N/A |

| lincoln financial | $622.43 | $1,201.73 | $2,678.77 |

| Protective | $632.63 | $1,304.19 | $2,800.00 |

| Haven Life | N/A | N/A | N/A |

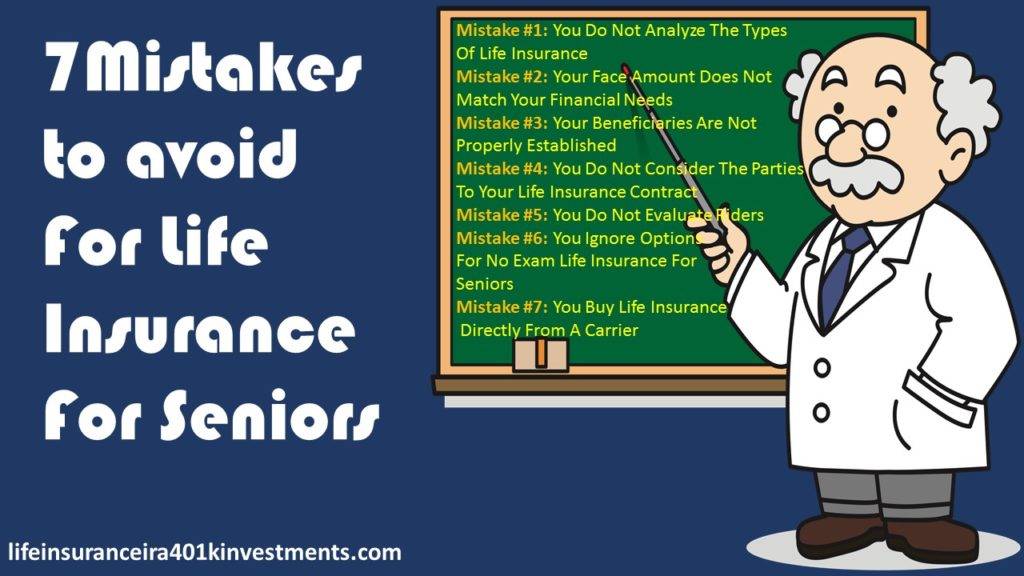

Best Life Insurance for Seniors Over 70 to 75 Now What They Don’t Tell You About Mistakes While Buying:-

Mistake # 1:

Not analyzing the types of life insurance

Seniors have several options to purchase life insurance for old age.If you don’t evaluate the different types of life insurance, you risk buying a policy that doesn’t suit your needs.

For example, if your life insurance requirements are only temporary, avoid higher premiums by purchasing a term life insurance over 70 to 80 policy.

What to do instead?

You will want to review the different types of cheap life insurance available to you. That way, protect those who matter most to you with the kind of life insurance that makes sense to you.

In this article, we will define and review the main types of life insurance available to seniors:

However, it is still possible to find affordable coverage plans. In fact, there are many coverage options for obtaining affordable life insurance quotes for people over the age of 75.

Don’t put it off as it just means paying a higher premium!

Once you’re over 60, monthly payments increase dramatically every year if you don’t have it blocked.

More importantly, answer the health questions honestly whether it is a term policy or a final expense. Another alternative is life insurance for people over 75 without a medical exam.

Subscription may be similar to health insurance for seniors without a medical exam, where there will be questions and a possible phone interview. In some cases, a medical checkup through the MIB.

Mistake # 2:

The amount of your face does not match your financial needs

The nominal amount of your life insurance for seniors over 70 policy is also known as the death benefit your beneficiaries receive.

Note: In addition to the face amount, permanent policies (such as Total, Universal, Final Expense) also have a cash value component.

Cheap life insurance is not for you. You buy life insurance to financially protect your loved ones.

If your policy is not for the right amount, especially if it is too small, the people who matter most to you may be in a difficult financial situation.

What to do instead?

Conduct a needs analysis, as older people have unique life insurance for seniors over 70 needs. An independent agent can help you with this.

Take a pencil and some paper and calculate the following:

- Annual income.

- Current financial obligations. (eg mortgages, debts, bills, personal loans)

- Future financial obligation plans. (eg charitable donations, college tuition for loved ones).

- At the end of the day, your policy should cover the financial loss that your loved ones would experience if you died.

Important: some life insurance for seniors over 70 to 80 is better than no life insurance. Even if you cannot buy a nominal amount that meets all of your financial needs, a modest policy (such as Final Expense) will provide you with some financial relief.

Mistake # 3:

Your beneficiaries are not properly established

If your policy does not adequately list who you want your death benefit to go to. There is a chance that your life insurance payment may not reach the people you want.

Instead, your death benefit can be directed to your estate (think about taxes and the time-consuming process).

This can easily happen to older people.

What to do instead

Plan to do three things, carefully:

- List your main beneficiaries. A primary beneficiary is the first to receive the death benefit. (eg spouse)

- Select a contingent beneficiary. Your primary beneficiary may not be able to receive your death benefit. Establish second-line beneficiaries. (eg children)

- Consider a tertiary beneficiary. Some life insurance for seniors over 70 policy owners choose to include third-party beneficiaries, who are third parties on the line to receive the death benefit. (eg grandchildren)

Note – There are some situations where contingent and tertiary beneficiaries are unnecessary. For example, sometimes older people establish an Irrevocable Life Insurance Trust (ILIT).

Important: check your policy regularly. Especially if a major change has happened in your life (marriage, divorce, birth, death), be sure to verify that your policy’s beneficiaries are up-to-date as needed.

Mistake # 4:

You don’t consider the parties to your life insurance contract

If there are multiple people involved in purchasing your life insurance for seniors over 70 policy. And there are often older people, you will want a firm understanding of the different parties to a life insurance contract.

Sometimes seniors will finalize the purchase of life insurance for seniors over 70 before understanding the main parts (and their functions) of a policy.

What to do instead

Get familiar with the main parts of a life insurance contract so you know how you want your policy to look. This is especially important if someone else wants to own and make their life insurance for seniors over 70 premium payments.

Parts of the life insurance policy:

- Insured: the person whose life is insured.

- Policy owner: the person (or entity) who owns the contract and is responsible for making premium payments.

- Beneficiary: the beneficiary of the death benefit in the event of the death of the insured.

Mistake # 5:

You don’t evaluate riders

Often overlooked, life insurance users have added benefits to their life insurance contracts. Seniors regularly insure a life insurance policy regardless of which passengers are available on the policy.

Ignoring passengers potentially means giving up the opportunity to use funds during a time when you need it most.

As example, if you are diagnosed with a serious illness, not having the right pilot can be financially devastating.

6 out of 10 adults in the United States have a chronic disease. – Centers for Disease Control and Prevention

What to do instead

When evaluating which life insurance for seniors over 70 company to apply with, be sure to look at the included (and available) passengers of the specific policy.

For example, the most widely used pilot is the Expedited Death Benefit. It gives you the option to accelerate a portion of your death benefit if you are diagnosed with a qualifying chronic, critical, or terminal illness.

Also, other common brokers for seniors to consider are:-

- Children’s Term: Option to provide life insurance for a child (or grandchild) on your policy.

- Waiver of Premium: Ability to waive premium payments in certain circumstances, such as disability.

- Accidental Death – Your death benefit increases (usually doubles) if you die as a result of a qualifying accident.

Mistake # 6:

Ignore the no-exam life insurance options for seniors

No medical exam life insurance for seniors over 70 is regularly an excellent option.

Sometimes older people inadvertently sign up for a physical exam when they want to skip it.

What to do instead

Know your options without a medical exam.

There are two situations in which we recommend older people to opt for an unexamined life insurance policy:

- He cannot bear the thought of needles, nurses, or liquid samples (or prefers to avoid discomfort).

- Your best life insurance option is a policy that never includes a medical exam (for example, the final expense is not always an exam).

Mistake # 7:

You buy life insurance directly from a carrier

Occasionally, seniors will apply for life insurance directly with a carrier.

We advise against this.

By submitting an application directly to a life insurance company, you risk not getting the best policy or the best rates.

What to do instead

Partner with an independent life insurance for seniors over 70 to 75 plan agent.

It is of interest to older people to analyze multiple quotes from multiple operators.

Here’s why: Your unique situation (age, health, financial obligations, desired passengers) will determine the ideal company to apply for. Every provider is different, and seniors will want to partner with an agent who advocates for their needs.

Life insurance quotes for seniors over 70 to 80 Age

To get a general idea of the cost, we have provided life insurance quotes for people aged 70+ to 80+ years old.

The quotes include Term, universal, total and final guaranteed expenses. That way, you can have a comprehensive understanding of roughly how much different types of life insurance can cost you.

A couple of things to keep in mind: Term life insurance quotes are for a term of 10 years. And, the quotes are based on healthy individuals, although the final expense subscription is very forgiving and the health conditions are not as worrisome.

Frequent Questions About Insurance

Can a 75-year-old man get life insurance?

Yes, although the underline guidelines with most carriers will tighten up due to age, even with major health issues we can find you a policy!

How much does life insurance cost for a 75-year-old?

Obviously, there will be more than 65 years, since the ages of mortality are upon us (Male 77, Female 81). But you can still get something affordable!

What is the oldest age to buy life insurance?

We offer life insurance up to age 89, carriers are limited, and most are no older than 85.

Can you get life insurance at age 85?

Yes, at 85 we have multiple carriers for burial insurance, if you want something bigger, a GUL is the best policy for people over 85 or over!

Can an 88-year-old man get life insurance?

Yes, we offer life insurance up to 89 years. The same company that offers health insurance plans offers burial insurance, AARP is best for you.

AARP Life Insurance Over 50 to 70

WHAT ARE THE FACTS ABOUT LIFE INSURANCE FOR OLDER CITIZENS OVER 75 YEARS OLD WITHOUT A MEDICAL EXAM?

So you might think that life insurance for people over 70 doesn’t have a medical exam! As long as you are not confined to a nursing home, you can get a no-medical exam policy with some companies.

Ultimately, when it comes to senior life insurance, many seniors would prefer not to undergo a medical exam to receive coverage for seniors.

In general, you may not like needles, or you may be in poor health or over 75. In general, you can choose a non-medical exam for guaranteed coverage. Consequently, the plans will be more expensive than a standard policy.

However, you can get insurance much faster without a medical exam life insurance for seniors over 70 policy. If you have a dangerous lifestyle, you should seek special risk coverage.

20 Years Term Life Insurance Over 50

Also, if you are over 50, you may consider the 20-year term life insurance policy to be the most affordable term.

However, a 30-year term is not available to those seeking coverage over 60.

For example, how much is life insurance for a 75-year-old who wants an unexamined policy?

Next we will see the rates for both men and women.

Above all, when you are purchasing term life insurance of 75 years or more, it is important to realize that some policies have more options built into the policy than saying a cheaper alternative.

As you can see above, American-Amicable is priced better, yet the Foresters policy is such a better product. Foresters offer over 70 life insurance without medical expenses up to $150,000!

Foresters Life Insurance Benefits

Foresters offer an additional clause on critical and chronic diseases to politics. That gives the insured access to the death benefit without dying. He is best known as a Living Benefits pilot.

At this age, it may be necessary. Plus, here is the sweetener, it also comes with a family health benefit.

This helps with family health expenses that occur during natural disasters that including hurricanes, tornadoes, and earthquakes.

Also, the time period for life insurance quotes for people over 70 with non-medical personnel can take anywhere from a few days to a couple of weeks to be approved.

Health Problems Change Life Insurance Rates

To clarify, if you have serious health conditions, like diabetes, getting coverage may be more difficult.

After all, in addition to quoting higher rates, general coverage may be declined. In this case, you can always go with guaranteed full life insurance for seniors over 70 to 80 years old age. This way, you will receive coverage, despite any medical problems.

However, guaranteed acceptance rates will be high in comparison. In some cases, a simple burial policy would suffice.

Furthermore, these policies are permanent.

Consequently, studies have shown that treated high blood pressure may be related to higher general disability in people with multiple sclerosis (MS).

Although the rate at which disability progresses may be slower than in patients without hypertension, a retrospective study concludes.

Furthermore, some studies have previously suggested an adverse effect of high cholesterol levels on the development of brain lesions in patients with multiple sclerosis (MS).

Again, if you are healthy, for the most part, the application process is very similar to the health insurance process. Especially a non-medical exam.

What You Need To Know About Health Impairment Ratings For People Over 75 Before You Apply

USA Seniors and people over 75 seeking coverage will have more challenges in obtaining coverage. Especially with the following pre-existing health problems.

Sleep Apnea Disorder: A standard rate is possible if the diagnosis is mild. Sleep Apnea and complies with the use of a CPAP daily. Table 2 possible severe and compliant, non-compliant is a decrease.

Atrial fibrillation: a standard rate is possible as long as it is paroxysmal/intermittent/recurrent, but normally classified in the T3-T7 table. If current heart failure, then a decrease.

Type 1 or 2 diabetes: Type 1 for people over 7 years old, since the diagnosis is a decrease. Type 2 diabetes if it starts with more than 66 years and a controlled A1C, is possible Standard Plus to Table 2.

Cancer patient survivors:

Depending on the type of cancer, never better than a standard rate and, in most cases, cancer-free for more than 5 years without repercussions.

Bipolar disorder: If an older person has bipolar disorder and it is mild with no history of suicide, then standard is possible if there is no antipsychotic medication.

Epilepsy/seizures: partial complex, after 6 months to two years from the last seizure table 3, 3-5 years table 2, after 5 years possible standard. Simple partial table 3 if within 2 years after the last seizure, after 2 years, then standard. Metabolic brain disease, within 5 years of self-deterioration.

Long Term Carriers For Over 75 Years

The best life insurance companies for people over 75

In general, many of our senior clients ask: What is the best life insurance for people over 75? Therefore, we will not only discuss with you the best operators, but we will also discuss the best affordable life insurance for people aged 75 and over!

The following are operators that have great coverage for people over 75:

- Prudential Life

- Foresters Life

- AIG Life

- Fidelity Life

- Protective Life

- Phoenix Life

- Sagicor Life

The above life insurance companies for people over 75 have an indulgent subscription. However, you will need to speak to us so we can determine your precise grade class.

In this way, we can locate you with the best life insurance for seniors over 70 option for your personal profile. This will ensure that you have the best life insurance for people over the age of 75. Get Free Compare Rates Quotes Instantly.