What is burial or funeral insurance for seniors?

Burial insurance, also known as funeral or final expense insurance, is an excellent life insurance option for open-care seniors. Help pay for funeral-related costs to help ease the financial and planning burdens for loved ones.

Plans range in price from about $20 to $288 per month for seniors, depending on age, gender, general health, and coverage they want.

Burial Insurance For Seniors

Like traditional cheap life insurance policies, these funds can be used to pay off the deceased’s outstanding debts after death. If you are considering adding this type of policy to your end-of-life plan.

Get a free online burial and funeral open care senior plan insurance quote with Lincoln Heritage Funeral Advantage today.

Choosing the best final expense insurance program for seniors:

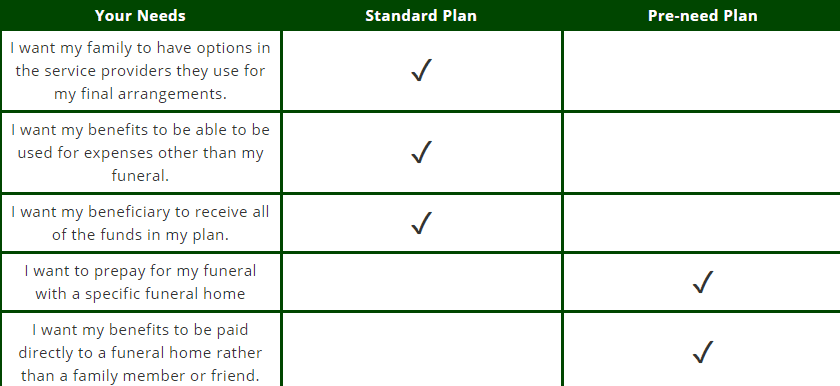

Selecting the right final expense insurance plan is a very personal decision. When deciding whether a standard or pre-need program is best for you.

It will be helpful to think about your needs and what you want your plan to cover. Then you can evaluate which open care senior plan is best for you.

How much does burial insurance for seniors cost?

The amount you will pay in premiums can be as low as $20 per month or as high as $286 per month, depending on the open care senior insurance company you choose, your age, gender, coverage amount, and general health.

Your rate will be cheaper if you are in good health and can answer “no” to the health questions on the application.

Some insurers may require a medical exam to qualify, but this is not always the case. If you have had health problems in the past or are taking certain medications, you may be issued a substandard or modified plan and your rates will be higher due to your health.

Finding Affordable Burial Insurance For Seniors

Seniors have many options for burial insurance coverage. It is important to get a personalized quote from two or three providers to find the best option for your needs and budget.

You can also work with an insurance agent, who will do the research for you and provide you with the options that he or she deems appropriate for you.

Be Smart: Determine the Best Value for You

As you get older, your requirements change when it comes to life insurance. Your children are likely to have grown up and live their own lives, and they do not depend on you to support them financially.

Also, you may have already paid off your mortgage and other debts. That’s why so many people over 50 see life insurance differently than they did in their 20s and 30s.

Open Care Senior Plans

If you are thinking about getting an open care senior plan insurance policy at your age, you should think carefully about what you want from your policy.

Do you want to leave a cash windfall for your loved ones, or make sure you pay your final expenses so they don’t have to?

Deciding what type of open care senior plan policy you need, how much coverage you should have, how long you need it.

How much you can afford will help make sure you select the right policy for you and your family if something happens to you.

Burial Insurance Benefits

People with new families often use burial insurance to support them when they can no longer. They want to make sure that their spouse and children can continue to live the life they have become accustomed to.

But once you reach 50, things change.

Even so, it still makes sense to provide your beneficiaries in some areas. For example, families experience a wide variety of strong emotions related to the death of a loved one, and the high costs of funerals can exasperate them.

This is why so many people who do not feel the need to provide a large cash payment to beneficiaries arrange for a burial insurance for seniors policy to pay for their funeral expenses.

And if you incurred medical bills, it’s a good idea to leave your beneficiaries enough money to pay them. The same is true for outstanding bills like utilities, car payments, and other normal living expenses. Get open care final expense plan and free quotes here.

Financial Dependents

If others are still financially dependent on you, you should consider them when thinking about life insurance.

For example, your spouse, children, or siblings can trust you for financial support. When you buy a life insurance policy, you can designate beneficiaries and make sure they are taken care of even after approval.

How much do you need?

Determining how much open care final expense plans are necessary is different for everyone.

For example, if your goal in getting a policy is to make sure your final expenses are paid, you can buy a policy with benefits of as little as $10,000.

On the other hand, if you want to financially support someone for a significant period of time, you will need to purchase a policy for much more. To determine how long, calculate how long that person needs to live and base your decision on that.

Burial Insurance Rates for Seniors 60 to 90

Senior rates vary based on age, gender, amount of coverage desired, and whether or not you answer health questions. Policies generally offer between $5,000 and $20,000 in benefits for people ages 50 to 85 (learn more about senior burial insurance for those over 50 to 85 age).

Some companies offer their products to people over the age of 85, and others have a maximum age limit for those to whom they offer plans. No matter what their age, many consumers choose coverage of around $10,000 so they can help cover the costs of their funeral.

You can get an idea of what you will pay in premiums for a common plan of $5,000 or $10,000 below here.

| Over 60 | Over 65 | Over 70 | Over 75 | Over 80 | Over 85 | Over 90 | |

| 1. | $5,000 Death Benefit | $5,000 Death Benefit | $5,000 Death Benefit | $5,000 Death Benefit | $5,000 Death Benefit | $5,000 Death Benefit | $5,000 Death Benefit |

| 2. | Women- $18 – $20 Men- $23 – $28 | Women- $22 – $27 Men- $29 – $38 | Women- $29 – $38 Men- $40 – $45 | Women- $42 – $50 Men- $55 – $61 | Women- $54 – $67 Men- $70 – $88 | Women- $72 – $99 Men- $93 – $150 | Women- $110 – more Men- $148- more |

| 3. | No Health Questions Asked | No Health Questions Asked | No Health Questions Asked | No Health Questions Asked | No Health Questions Asked | No Health Questions Asked | No Health Questions Asked |

| 4. | Determined ‘In Good Health’ by Insurer | Determined ‘In Good Health’ by Insurer | Determined ‘In Good Health’ by Insurer | Determined ‘In Good Health’ by Insurer | Determined ‘In Good Health’ by Insurer | Determined ‘In Good Health’ by Insurer | Determined ‘In Good Health’ by Insurer |

| 5. | Pay low premiums | Pay low premiums | Pay low premiums | Pay higher premiums | Pay higher premiums | Pay higher premiums | Pay higher premiums |

| 6. | Apply USA all States | Apply USA all States | Apply USA all States | Apply USA all States | Apply USA all States | Apply USA all States | Apply USA all States |

| 7. | Policy End Anytime | Policy End Anytime | Policy End Anytime | Policy End Anytime | Policy End Anytime | Policy End Anytime | Policy End Anytime |

Why is life insurance more expensive after 50?

Most life insurance companies charge higher monthly premiums as you get older. There are several reasons for this.

But most of the reasons focus on the fact that the typical person experiences more health problems once they reach 50. In fact, approximately 75 percent of Americans over the age of 50 take regularly one or more prescription drugs.

If you have an existing health problem, qualifying for life insurance can be a challenge depending on the severity of the condition. And if you are in “moderate” or “poor” health, it may be considered a higher risk for insurance providers.

To offset this additional risk, insurance companies charge higher premiums to ensure that they have accumulated enough funds to pay the death benefit if the insured dies early.

Life Insurance For Tobacco Smokers

Tobacco use is another common reason for higher premiums. If you are over 50 and use or have used cigarettes or chewing tobacco, you can expect a higher insurance premium.

Smokers are more likely than nonsmokers to develop heart disease, have a stroke, or develop lung cancer. Due to these additional health risks, tobacco users pay higher rates.

What to look for in affordable life insurance?

Your insurance needs have probably changed since you purchased a life insurance policy. Meeting regularly with your agent to review your coverage is a good way to continue protecting what matters most to you.

If you are buying life insurance for the first time, start by evaluating what obligations you have.

- Does anyone depend financially on you?

- Do you have outstanding debts like a mortgage or car payment?

- Ask yourself, “Who (or what) am I trying to protect with this policy?”

Answering this question will help you know what to look for in your life insurance policy.

Are you trying to replace the income your family would lose if you passed away?

Do you want to cover the funeral expenses?

Pay a mortgage?

Find a policy that can address those specific needs if you die.

Buying burial insurance is much like buying a new car: the prices of various models can be relatively the same, but the specific characteristics can vary significantly.

When looking for coverage, carefully compare the benefits offered by each life insurance provider. Don’t automatically choose low-cost life insurance just because the cost is attractive. There may be a policy with characteristics more aligned with your needs, even if it is more expensive.

Because premiums are higher for those over 50, finding affordable funeral expenses insurance can be a challenge. Choose a policy that can reasonably pay for today, tomorrow and the foreseeable future.

Open care final expense plan

Your circumstances can change at any time, so it is important to choose something that does not become a burden. Having to cancel a policy.

It is too expensive can cause you to lose the premiums you have already paid and may affect your ability to qualify for coverage later if your health changes.

This is why it is so important to make sure that the open care final expense plan coverage you select is affordable.

No medical examination considerations

Some no exam insurance companies offer policies that do not require applicants to undergo a medical examination. This can be important for people over 50 because it is usually the age when medical problems begin to arise.

When searching for this type of policy, look for policies that are a simplified problem or offer guaranteed approval.

Compare your options:

When purchasing a simplified problem policy, you will need to answer some medical questions on the application form.

But you will not have to undergo a medical examination. A good example of a simplified life insurance policy is final expense insurance.

What is the best life insurance for people over 50?

You should think about customizing your life insurance policy for your specific situation. But before you can choose a policy, you must understand your options.

You can choose from three basic life insurance for seniors policies. Let’s take a look at these now to help you determine which coverage is best for you.

Final expense life insurance

Depending on your needs and age, end-of-life life insurance may be best for you. You may not have children who need a large inheritance.

You may not be able to pay the high premiums of typical full senior life insurance, but you want to take care of your final expenses instead of leaving them for your loved ones.

Commonly called “burial insurance” or “funeral insurance,” it is a type of whole life insurance for seniors specifically designed to address the final expenses you leave behind.

Such as unpaid medical bills and funeral costs. Some final expense policies are considered affordable life insurance because coverage can often start from $15 per month.

Funeral expenses alone can cost up to $9,000, but having even a small final expense policy can help your family cover these costs.

Best Burial Insurance Companies Options:

| 1. | AARP Guaranteed Acceptance Life Insurance | $25,000 | 60 to 90 Age |

| 2. | Transamerica Immediate Solution | $50,000 | 60 to 90 Age |

| 3. | Globe Life Final Expense Insurance | $25,000 | 60 to 90 Age |

| 4. | Fidelity Life Ins Best for Convenience and Speed Claim | $35,000 | 60 to 90 Age |

| 5. | AIG Direct Guaranteed Issue Whole Life Insurance: | $55,000 | 60 to 80 Age |

| 6. | Colonial Penn | $25,000 | 70 to 90 Age |

| 7. | Mutual of Omaha | $45,000 | 60 to 90 Age |

| 8. | Assurity Life Insurance | $40,000 | 70 to 90 Age |

Because premium amounts and coverage generally don’t change for lifetime policies (as long as you pay premiums), end-of-life insurance is a great option if you’re over 50 or your health is poor. deteriorates.

The longer you put off buying such a policy, the more expensive it will be and the more likely it is that your health will change. Ensuring an affordable insurance rate while in top health can save you hundreds of dollars in the future.

Life Insurance For Elderly Parents

End-of-life life insurance generally offers smaller amounts of coverage than other insurance for elderly parent policies, making them more accessible and easier to qualify for.

Because the amount of coverage is lower than most other types of life insurance, some final expense policies do not require a medical exam to qualify. Many policies can be issued based on the answers to the health questions on the insurance application.

Term of life insurance

Term life insurance is only valid for a “term”. That means you must request (and qualify for) a new policy each time the term expires. For example, if you purchase a ten-year term life insurance policy, once it expires, you no longer have life insurance.

The problem with this type of policy for people over 50 is double. Qualifying for term life insurance for seniors becomes more difficult as your health changes

Each new term becomes more expensive because it is higher each time you renew your finished. Term premiums can vary by thousands of dollars depending on your renewal age.

Also, most term policies do not accumulate cash value. Compare Whole vs. Term Life Insurance:-

| Policy Options | Term Life Insurance | Whole Life Insurance | Choose Term Life If You- | Choose Whole Life If You- | |

| 1. | Choice of policy length | Yes | |||

| 2. | Provides lifelong coverage | Yes | |||

| 3. | Premium generally stays the same | Yes | |||

| 4. | Low premium | Yes | |||

| 5. | Life insurance payout amount is guaranteed | Yes | |||

| 6. | Accumulates cash value | Yes | |||

| 7. | Might be eligible for annual dividends | Yes | |||

| You only need life insurance to replace your income for a certain period, such as the years you raise children or pay your mortgage. | You want to provide money for your heirs to pay estate taxes. In 2020, properties that are worth more than $ 11.58 million per individual or $ 23.16 million per couple are subject to federal property taxes. State property taxes vary. Here is a map of the state estate and inheritance taxes from the Tax Foundation. | ||||

| You want the cheapest coverage. | Have heirs who may be forced to sell parts of your estate to pay the tax bill without insurance. | ||||

| You think you may want permanent life insurance but cannot afford it. Most term life policies are convertible into permanent coverage. The conversion deadline varies by policy. | Having a dependent for life, such as a child with special needs. Life insurance can finance a special needs trust to provide care for your child after you are gone. Consult with an attorney and financial advisor if you want to establish a trust. |

Whole life insurance

In general, full life insurance is usually the best life insurance for people over 50. Coverage and premium generally remain.

Same for the life of the policy as long as premiums are paid, and some plans may accumulate a cash value that can be used later. in life.

Whole life insurance is often referred to as “permanent insurance” because it has no policy terms and does not have to be re-qualified.

Universal life insurance

If you want a permanent life insurance policy like whole life products but with a little more flexibility, a universal life insurance policy might be right for you.

With this type of policy, you get all the benefits of a permanent life insurance policy but have some flexibility in how you use it.

For example, you may have the option to change your benefits to suit your life circumstances. And because universal life insurance also has a cash value component, you can use it to pay your premiums if the value is enough to cover them.

Do people over 50 need life insurance?

It is a mistake to think that people over 50 don’t need life insurance. The truth is, there are many reasons why those over the age of fifty and older will benefit from life insurance. Here are a few things to consider.

If people are financially dependent on you, they may have a hard time making ends meet when you’re gone. Without a life insurance plan, basic bills can go unpaid.

Funeral Expense Insurance

Funeral expenses can easily exceed $9,000, but you don’t have to bear your loved ones with that financial burden. By purchasing life insurance, your burial costs, medical expenses, and other outstanding bills can be met.

If you plan to leave your estate to your loved ones, they may have to pay estate taxes.

Not everyone can pay taxes, and some people have to sell personal items just to pay for them. But if you name them as beneficiaries on your life insurance policy, they can use the cash to pay those taxes.

If you leave a business to your beneficiaries, having a life insurance policy is one way to ensure that they will have the funds they need to run the business.

What features are useful for people over 50?

Different types of insurance policies include several features that are useful for people over 50. Here is a list of some of the features you can take advantage of.

A single premium policy, also known as a payment policy, allows you to pay the life of the policy upfront and never have to worry about monthly premiums as you get older.

Because you are earning potential decreases as you age, an accelerated feature allows you to pay more in premiums at the start of the policy and enjoy lower premiums once you retire.

The cash value of a whole life insurance policy is yours, even if you cancel the policy. And it has tax deferred.

If you need to get a loan against your cash value, you can do it.

What are other types of insurance to consider?

Whether you buy a full or term life insurance policy, you can find several policies that may be more suitable for your circumstances. For example, here are some types of policies that are perfect for people over 50:

Survival Life:

This is a complete life insurance policy. When older couples have a disabled child, they often worry about what will happen when they leave.

But you can buy this type of burial insurance for seniors policy to protect your child once they are both gone. The policy is not paid until both have passed. Buying this type of policy is less expensive than if you had to purchase two policies for both.

Convertible:

With this type of burial insurance for seniors policy, you can start with a term policy, and when it expires, you can convert it to a whole life policy without a medical exam.

Decreasing Term:

If your goal is to support your family so they don’t have to pay your debts, a decreasing-term life insurance policy can help. Payments start lower, but the death benefit decreases over time. This is a term insurance policy, and if you pay your debts before approval, you can cancel the policy.

Renewable Annual Term:

If you need a term life insurance policy for a specified number of years, for example, a few years before you retire. This type of term policy will automatically renew without having to pass underwriting medical exams.

But keep in mind that although the policy is renewed, your premiums will increase every year.